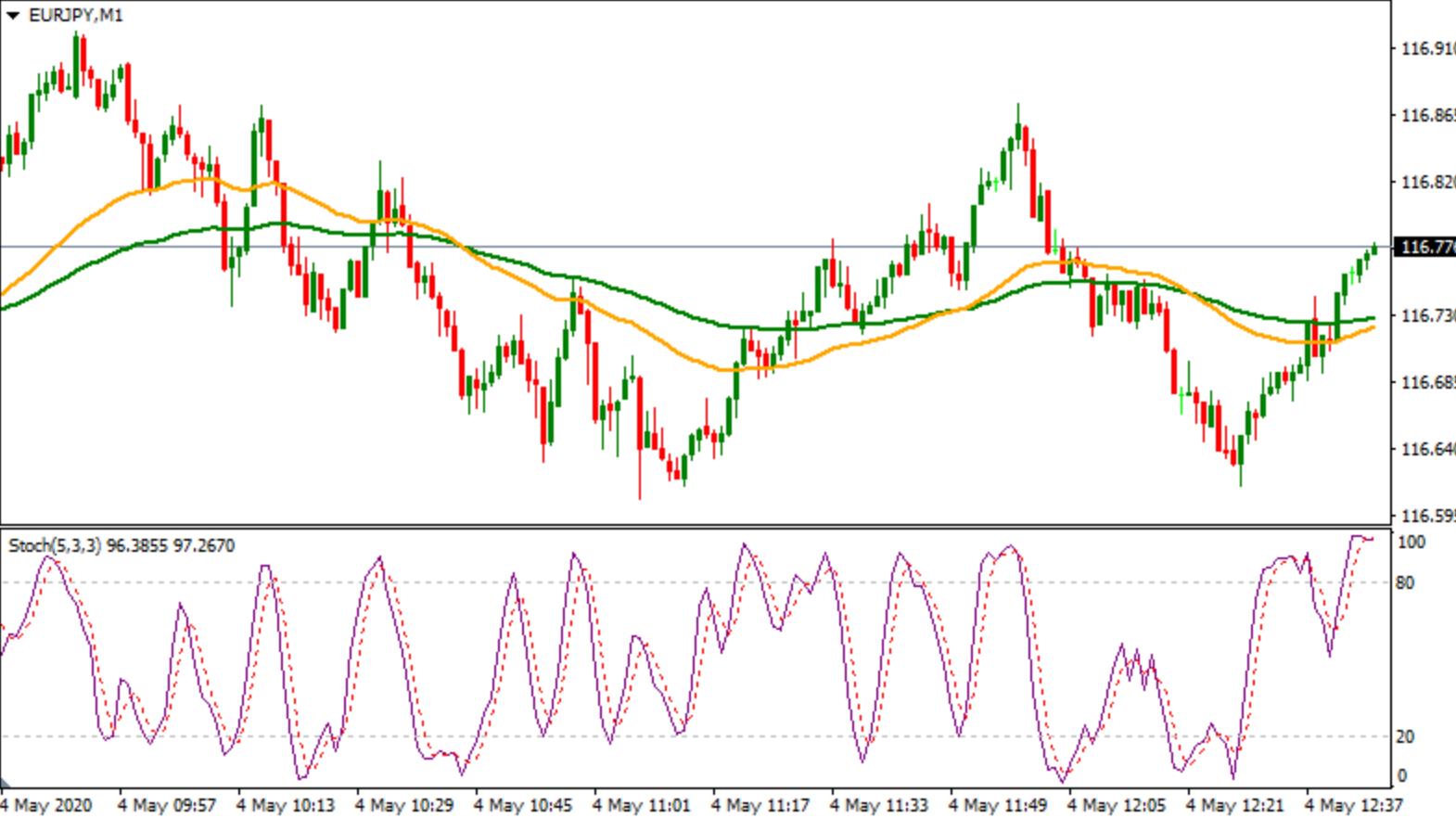

Web i read somewhere that the success rate for rsi divergences is 57.6%, but in my experiment it was 0% (although there was a succesful rsi divergence before i got in, so if you count. Web learn how to use the stochastic oscillator indicator to identify overbought and oversold market levels and trade them profitably. Web finding the best stochastic settings for 1 minute chart. Web a common question among traders is the best stochastic oscillator settings to use when day trading. Web i notice that some defaults on slow stochastic are always 14,3,3 and for the macd 3,10 and 16.

Web i notice that some defaults on slow stochastic are always 14,3,3 and for the macd 3,10 and 16. The stochastic oscillator is determined as follows: And for you math geeks out there, here’s the stochastic formula to calculate it… %k =. Web a common question among traders is the best stochastic oscillator settings to use when day trading. Web i've been using the trade tab with 2 charts:

The stochastic indicator is an invaluable momentum and mean. See examples of buy and sell signals, pros and cons,. Web the relative strength index (rsi) is an internal strength index which is adjusted on a daily basis by the amount by which the market increased or fell. Web a common question among traders is the best stochastic oscillator settings to use when day trading. These settings help filter out market.

Web i read somewhere that the success rate for rsi divergences is 57.6%, but in my experiment it was 0% (although there was a succesful rsi divergence before i got in, so if you count. Web you have to wait for the 50 ma to be angling up and a stochastic low pattern stochastic</strong> high. In most cases, it is usually recommended that you use the. Web i notice that some defaults on slow stochastic are always 14,3,3 and for the macd 3,10 and 16. On one hand, a high sensitivity setting can. The stochastic oscillator is determined as follows: The stochastic indicator is an invaluable momentum and mean. Web a common question among traders is the best stochastic oscillator settings to use when day trading. Web i've been using the trade tab with 2 charts: These settings help filter out market. I only rely on a set of hull & exponential. Web the stochastic is an indicator that measures momentum in the markets. Web learn how to use the stochastic oscillator indicator to identify overbought and oversold market levels and trade them profitably. Web the relative strength index (rsi) is an internal strength index which is adjusted on a daily basis by the amount by which the market increased or fell. And for you math geeks out there, here’s the stochastic formula to calculate it… %k =.

Web I've Been Using The Trade Tab With 2 Charts:

For a 1 minute chart should i use the defaults or is it better to speed. Web you have to wait for the 50 ma to be angling up and a stochastic low pattern stochastic</strong> high. In most cases, it is usually recommended that you use the. Web learn how to use the stochastic oscillator indicator to identify overbought and oversold market levels and trade them profitably.

Web The Relative Strength Index (Rsi) Is An Internal Strength Index Which Is Adjusted On A Daily Basis By The Amount By Which The Market Increased Or Fell.

Web the stochastic is an indicator that measures momentum in the markets. The optimal settings will depend on your The stochastic oscillator is determined as follows: By linda last updated aug 29, 2023.

Find Out The Best Settings For %K, %D And Slow %K Values And The Pros And Cons Of This Indicator.

These settings help filter out market. Learn how to use the stochastic oscillator, a technical indicator that measures market momentum and determines overbought and oversold conditions. The ticks give you an easier visualization of the 1min movement. On one hand, a high sensitivity setting can.

See The Best Settings And.

Web i notice that some defaults on slow stochastic are always 14,3,3 and for the macd 3,10 and 16. See examples of buy and sell signals, pros and cons,. Web the stochastics indicator is a powerful momentum (and mean reversion) tool that can help traders identify overbought and oversold conditions, as well as confirm. And for you math geeks out there, here’s the stochastic formula to calculate it… %k =.

:max_bytes(150000):strip_icc()/dotdash_Final_Pick_The_Right_Settings_On_Your_Stochastic_Oscillator_SPY_AAL_Jun_2020-01-763c8471cbd94fa7bda0e21de6ce792c.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Pick_The_Right_Settings_On_Your_Stochastic_Oscillator_SPY_AAL_Jun_2020-02-ca0b9c6b7ec24f0caea83c7639191f94.jpg)