Web understanding them, and the various historical chart patterns are what allows crypto traders to interpret and analyze the trend of the market and make pattern trading decisions. Web crypto graph patterns assess a market’s psychology through its price action. This guide will dive into some of the best crypto chart patterns that can be used by experienced traders and beginners alike. Web in this article, we cover some of the most common crypto chart patterns that expert traders use on a daily basis. In fact, this skill is what traders use to determine the strength of a current trend during key market.

Success rates of various patterns. Web crypto chart patterns are useful in identifying these price trends. The analysis also highlights a contradicting forecast that clouds jd’s hope. Web crypto chart patterns appear when traders are buying and selling at certain levels, and therefore, price oscillates between these levels, creating candlestick patterns. Web candlestick patterns such as the hammer, bullish harami, hanging man, shooting star, and doji can help traders identify potential trend reversals or confirm existing trends.

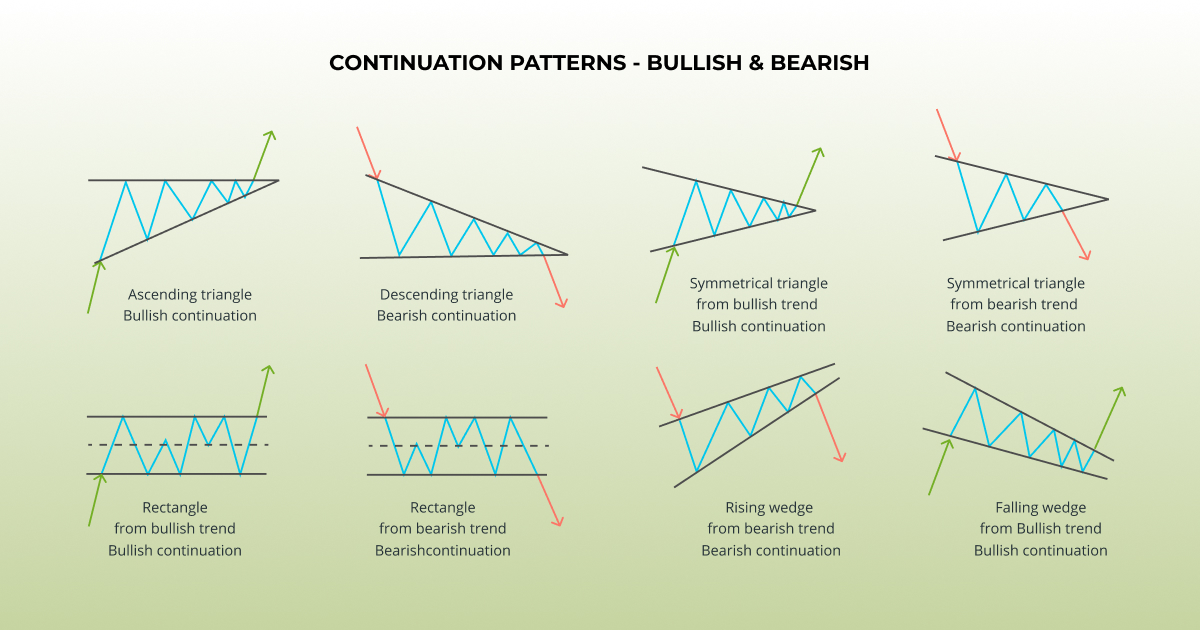

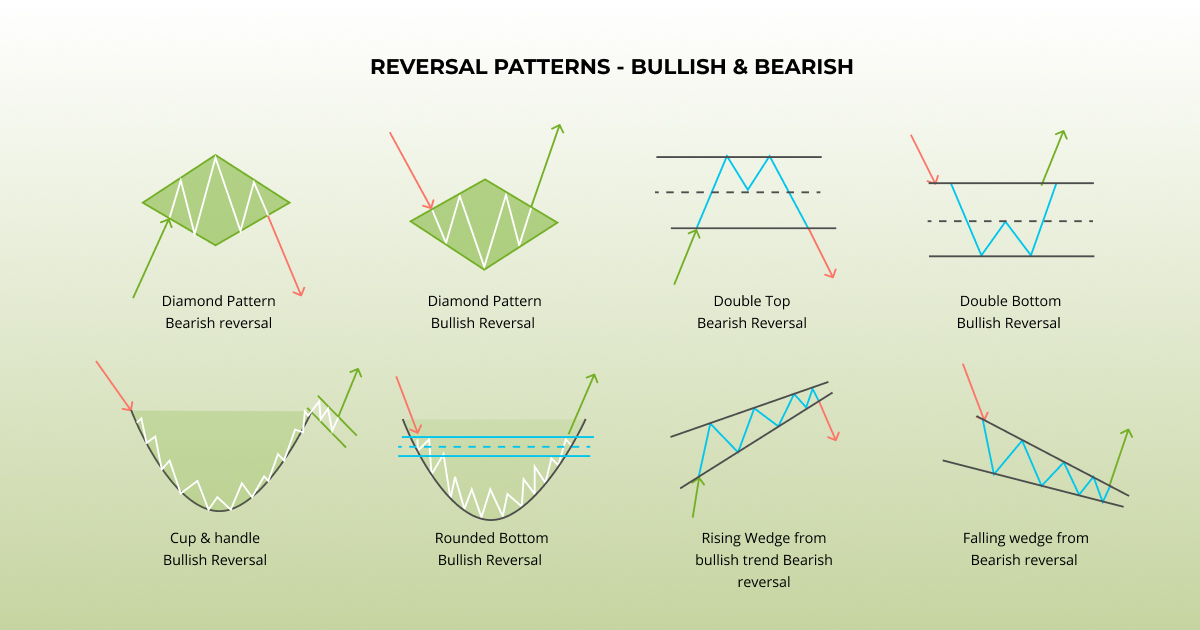

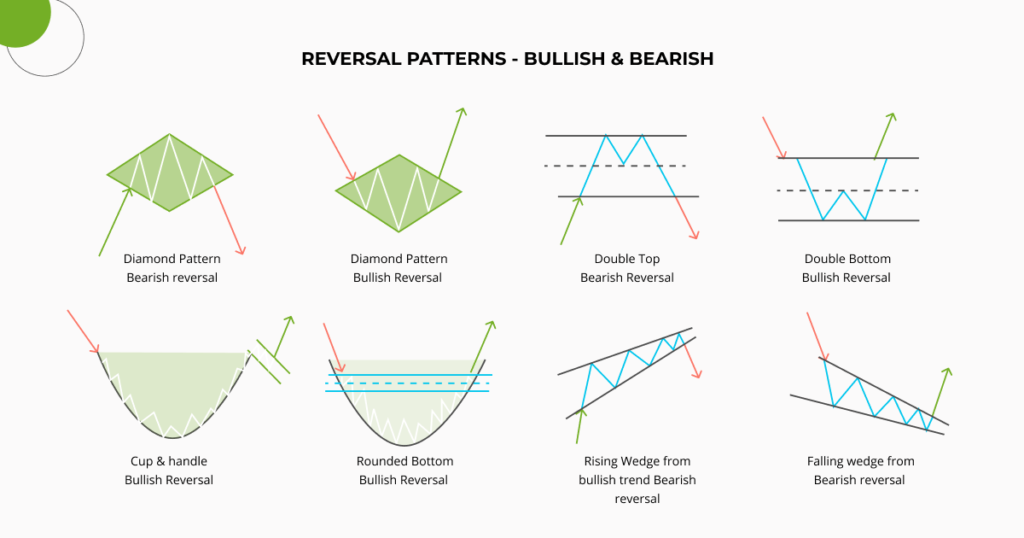

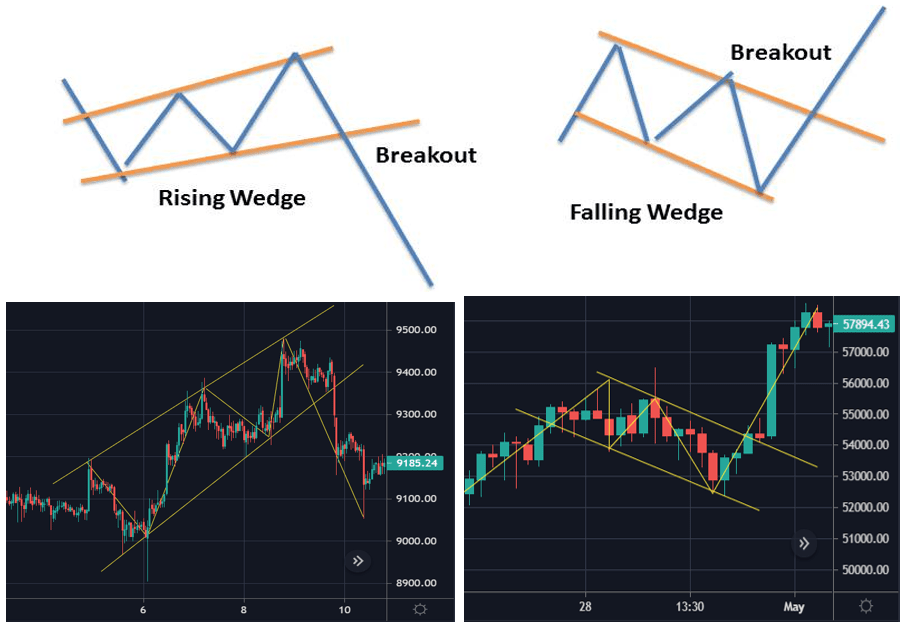

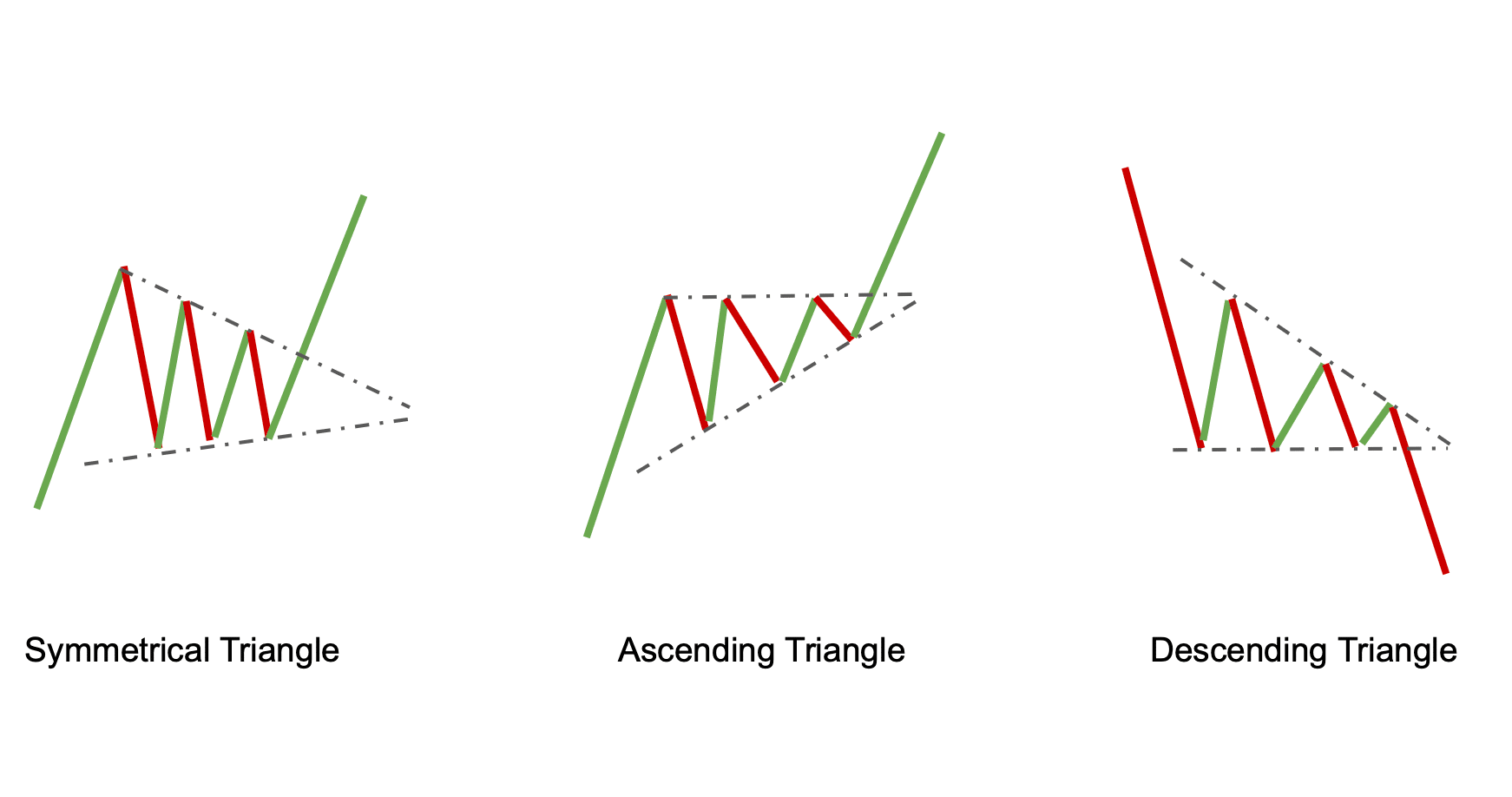

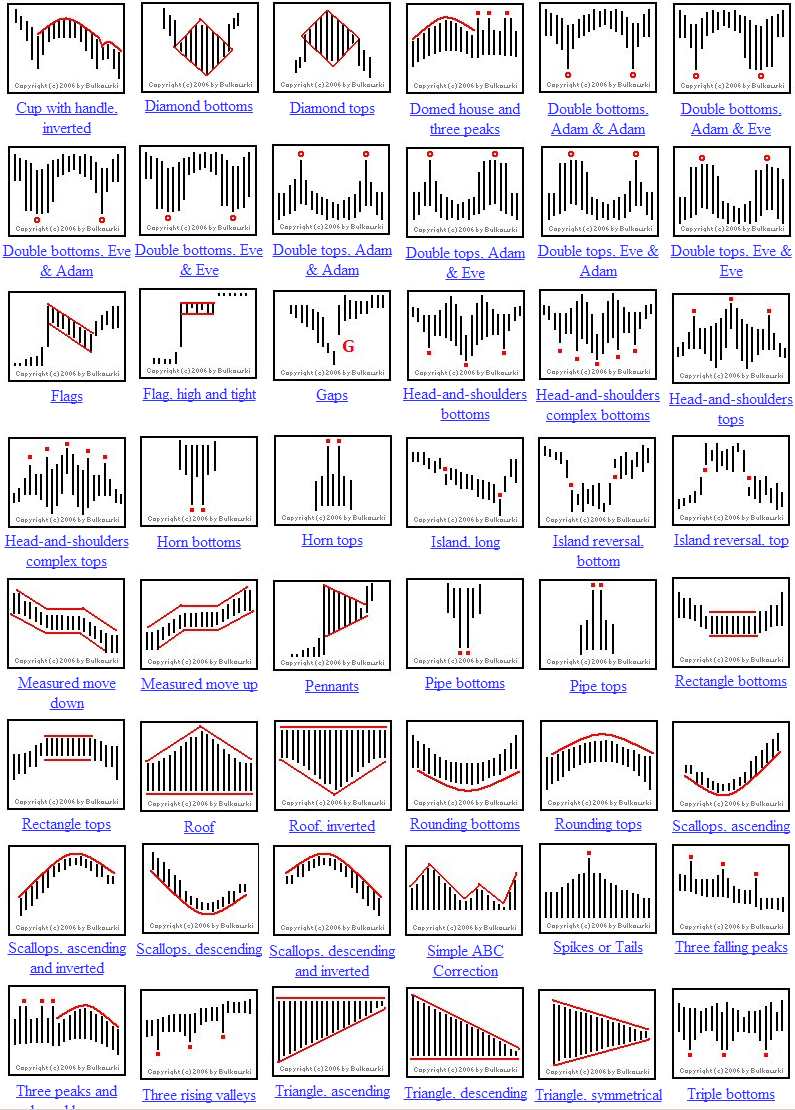

Traders should also consider other factors, such as volume, market conditions, and overall trend direction, when making trading decisions. Web chart patterns are formations that appear on the price charts of cryptocurrencies and represent the battle between buyers and sellers. Web 10 steps for how to trade crypto using chart patterns important tips on how to best use chart patterns for trading, including: Investing in cryptocurrency carries a unique set of opportunities and. Triangle rectangle, pole and exotic chart patterns.

Web doge market cap currently at $17.6 billion. Success rates of various patterns. Triangle rectangle, pole and exotic chart patterns. Web while reading chart patterns may seem daunting for crypto newcomers, they are integral to any good trading strategy. In fact, this skill is what traders use to determine the strength of a current trend during key market. Web use this guide to help you earn money consistently from day trading crypto chart patterns accurately for profits. Web crypto graph patterns assess a market’s psychology through its price action. Web crypto chart patterns, frequently combined with candlestick trading, provide a visual story of how prices have behaved in the markets and often indicate a bullish, bearish, or neutral emotion. Let's take a look at 7 popular crypto chart patterns, and how you can use them. Web crypto traders have identified a bullish pattern on the solana price chart, triggering anticipation for more rallies as solana’s price gained 17% in the past week. Which crypto assets are used for pattern recognition? Technical data showing a neutral mood and a fear & greed index value of 61 (greed. Web chart patterns are unique formations within a price chart used by technical analysts in stock trading (as well as stock indices, commodities, and cryptocurrency trading ). More importantly, we will provide some useful pattern day trading examples for each one of them, so. Familiarize yourself with the most common patterns, like head and shoulders, cup and handle, flags, and triangles.

Let's Take A Look At 7 Popular Crypto Chart Patterns, And How You Can Use Them.

This guide will dive into some of the best crypto chart patterns that can be used by experienced traders and beginners alike. Over time, a bullish market suggests that the price trend will continue to rise, whereas an adverse market indicates the reverse. Web top 20 most common crypto chart patterns, what they mean & downloadable pdf cheat sheet (included). Web doge market cap currently at $17.6 billion.

Web 10 Steps For How To Trade Crypto Using Crypto Chart Patterns.

Web in the world of crypto trading, recognizing patterns can yield more than insights. The first video is free to watch for anyone who follows the link and joins our telegram community. These patterns can indicate potential price movements. Web crypto chart patterns are recognizable forms or shapes on a cryptocurrency’s price graph that traders use to study market psychology and predict the likelihood of future movements.

Technical Data Showing A Neutral Mood And A Fear & Greed Index Value Of 61 (Greed.

Web candlestick patterns such as the hammer, bullish harami, hanging man, shooting star, and doji can help traders identify potential trend reversals or confirm existing trends. Familiarize yourself with the most common patterns, like head and shoulders, cup and handle, flags, and triangles. More importantly, we will provide some useful pattern day trading examples for each one of them, so. Web to give a simple definition, crypto chart patterns are formations and trends, used in technical analysis to measure possible crypto price movements, which helps traders to make informed decisions about their next move or identify the best time to buy or sell opportunities in the market.

Web In This Article, We Cover Some Of The Most Common Crypto Chart Patterns That Expert Traders Use On A Daily Basis.

Web use this guide to help you earn money consistently from day trading crypto chart patterns accurately for profits. Due to some chart patterns signaling different things depending on when they occur, there are multiple entries for the same stock chart patterns. Web in this article, we cover the top 20 most common crypto chart patterns and what they mean. Web these twenty trading patterns are categorized into four groupings: